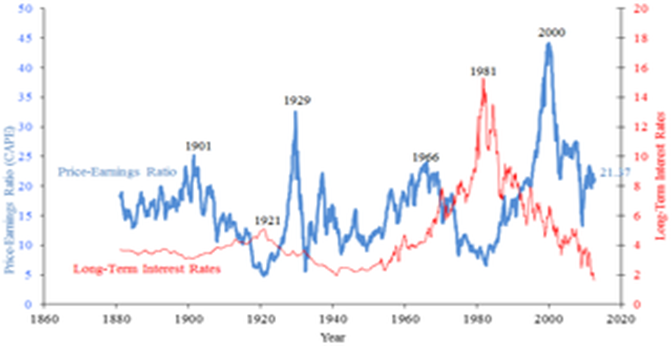

Image source: en.wikipedia.org

Ratio analysis tools are used to examine the company’s financial statements and determine the financial health of a particular company. There are various types of ratios used and one of them is a price to earnings ratio (P/E).

The P/E ratio determines the relationship between the company’s stock price and its earnings. PE allows you to invest throughout a market cycle. Let’s look at the pros and cons of the P/E ratio.

Pros:

**1. Widely used: **The P/E ratio is widely used in the stock market and even for financial stocks like banks and insurance companies.

**2. Easy to compute: **Price-earnings ratio is very easy to calculate. You only need the share price and the EPS (earning per share).

**3. Price of stock: **Enable investors to know how much they have to pay for each dollar in return for the stock. They can rely on this information to determine undervalued stocks.

**4. Determine growth potential: **PE ratios help investors to determine the company’s growth potential before they invest. The ratios show companies that can be affected by dramatic price correction. High PE leads to a selloff of the company whereas low PE shows a sustained growth of the company.

**5. Future forecasts: P/E measures the future prospects of a company by taking into consideration the present conditions of the company and comparing it with past performance. It also determines what is being generated for the shareholders. **

**6. Comparison: PE is used to compare and value companies’ stocks with one another making it a useful analytical tool. It provides context for the company within a specific sector. **

**7. Make quick decisions: Although the P/E ratio evaluates the worthiness of the company, it can be used to make quick decisions on whether to invest or not. **

**8. Benchmarking tool: P/E is an excellent benchmarking tool for determining whether the stock is overvalued or undervalued. It also determines the actual expectation of the company. **

Cons:

**1. No debt/financial structure: Price-earnings does not consider debt/ financial structure when computing the financial statements. **

**2. Accounting policies: Different accounting policies undermine the comparisons of PE across different companies and countries. These policies include the depreciation methods used, amortization, and tax system. **

3. Subjective in nature: The volatile nature of stocks makes it difficult to know what price-earnings we can sell at making P/E subjective in nature.** **

**4. Increased cost risk: The gearing up or share buy-backs can increase the earnings of the company but this can lead to increased cost of risk for it to be achieved. **

5. Misleading information: P/E can mislead companies operating on leverage. The periodic inflated earnings through the sale of corporate assets can lead to abnormal earnings. These earnings make the P/E ratio to be unrealistic.

**6. Overvalued shares: Investor optimism can lead to inflated stock prices for the entire sector. **During the recession, shares are undervalued in terms of their P/E. During inflation, the earnings of the company are evaluated based on the currency of the specific country and this can increase the P/E.

**7. Poor decisions: To achieve the target earnings may lead to poor decisions that affect the business. **

**8. Not suitable to evaluate losses: **Companies making losses cannot use the PE ratio since it can’t determine losses at the early stages of business growth.

9. Historical earnings: P/E earnings are based on historical data and these earnings are difficult to predict since they can’t predict future earnings.** **

10. Manipulations: Investors tend to over-price the shares if the business and economic environment are facing challenges. This leads to high P/E.